Understanding Crypto Calculators: A Guide to Making Informed Investment Decisions

In the rapidly evolving world of mining crypto calculator making informed investment decisions is crucial. One of the essential tools for crypto investors is the crypto calculator. This article aims to demystify what crypto calculators are, how they work, and how they can assist you in your investment journey.

What is a Crypto Calculator?

A crypto calculator is a digital tool designed to help investors estimate various aspects of their cryptocurrency investments. These calculators can provide calculations for a wide range of metrics, including:

- Profitability: Calculate potential profits or losses based on factors like initial investment, current market price, and projected price changes.

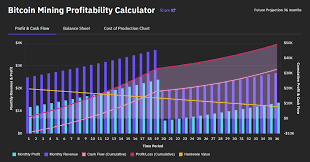

- Mining: Estimate mining profitability by inputting parameters such as hash rate, power consumption, electricity cost, and mining pool fees.

- Staking Rewards: Calculate potential returns from staking cryptocurrencies by inputting details such as staking amount, annual interest rate, and staking period.

- Trading Fees: Estimate trading fees based on transaction volume and exchange rates.

How Do Crypto Calculators Work?

Crypto calculators operate using specific algorithms and formulas tailored to each calculation type. They typically require users to input relevant data points, such as:

- For profitability calculators: Initial investment amount, expected or current market price, and duration.

- For mining calculators: Hash rate, power consumption (in watts or kilowatts per hour), electricity cost per kilowatt-hour, and pool fees.

- For staking calculators: Staking amount, annual percentage yield (APY), and staking duration.

Once the necessary inputs are provided, the calculator processes this information to generate outputs that help investors make informed decisions.

Choosing the Right Crypto Calculator

When selecting a crypto calculator, consider the following factors:

- Accuracy: Ensure the calculator uses up-to-date data and realistic assumptions.

- User-Friendliness: A good calculator should be easy to use, with clear instructions and explanations of terms.

- Range of Calculations: Look for calculators that cover various aspects of cryptocurrency investing, such as mining, staking, and trading.

- Feedback and Reviews: Check user reviews and feedback to gauge the reliability and effectiveness of the calculator.

Practical Uses of Crypto Calculators

- Investment Planning: Estimate potential returns on investment to make informed decisions about buying, selling, or holding cryptocurrencies.

- Mining Operations: Calculate profitability to determine whether mining specific cryptocurrencies is financially viable.

- Staking Strategies: Plan staking activities to maximize returns and optimize staking periods based on projected rewards.

Conclusion

Crypto calculators are indispensable tools for both novice and experienced cryptocurrency investors. By utilizing these calculators, investors can mitigate risks, maximize profits, and make well-informed decisions in the dynamic world of digital assets. Whether you are considering mining, staking, or simply holding cryptocurrencies, leveraging these tools can significantly enhance your investment strategy.

In conclusion, understanding and using crypto calculators effectively can empower you to navigate the complexities of cryptocurrency investments with confidence and clarity.